By Jonathan Baird – January 15, 2022

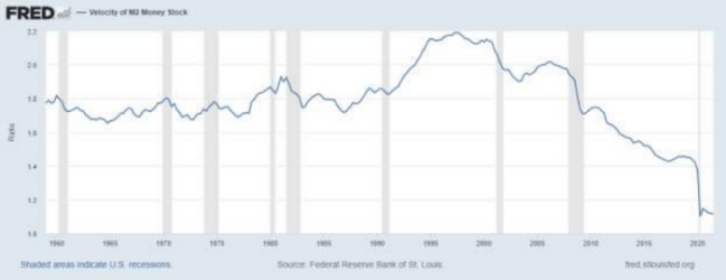

THE VELOCITY OF MONEY IS AT ITS LOWEST LEVEL SINCE THE GREAT DEPRESSION DESPITE PERSISTENT INFLATIONARY PRESSURES

The velocity of money (the frequency at which money changes hands) sits near all-time lows and is again slowing, following a short-lived stimulus-induced boost in 2020.

The velocity of money reached a peak in the late 1990s before declining in response to the crash of the internet stock bubble. It then began to recover before dropping sharply because of the Financial Crisis of 2008. Most noteworthy, money velocity continued to decline. This is indicative of the fundamental weakness of the world economy, which has relied heavily on central bank intervention and tax cuts to fuel economic growth since 2008.

The current low level suggests that recovery from this recession will be more gradual than consensus expectations, as stimulus efforts will have difficulty gaining traction. The tiny increase in the velocity of money produced by the huge fiscal stimulus applied by the government, before quickly resuming its downtrend, attests to the fragile nature of the US economy and, indeed, the global economy.

One might have expected that the velocity of money would have risen in 2021 as persistent inflationary pressures would have discouraged deferring spending. That it has not suggests that consumer psychology has yet to embrace the expectation that inflationary pressures will be long-lived, as in the 1970s.

The influences represented by the low velocity of money will colour the economic path ahead as well as the investment risks and opportunities presented to investors.

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues of our paid service and to receive our free weekly investment comment please visit: https://globalinvestmentletter.com/sample-issue/

Posts You May Like

THE MOST SIGNIFICANT CHART OF 2022: CAPITAL FLOWS INTO EQUITIES WERE GREATER IN 2021 THAN THE COMBINED INFLOWS OF THE PREVIOUS 19 YEARS

By Jonathan Baird - December 7, 2021 We have long found that the analysis of capital flows, investor sentiment and market extremes are among the most useful factors to consider in producing superior investment [...]

THE INTANGIBLE STOCK MARKET?

By Jonathan Baird - November 16, 2021 The ratio of tangible to intangible (e.g., goodwill) has changed substantially over the years. In 1975 fully 83% of the S&P 500’s total assets were classed as [...]

THE VALUE OF GLOBAL STOCK MARKETS EQUALED WORLD GDP IN 2021 FOR ONLY THE SECOND TIME IN HISTORY

Global stock markets, fueled by a combination of unprecedented fiscal and monetary stimulus and extreme investor optimism, have soared to match the value of global GDP. The only previous example of this behaviour [...]