By Jonathan Baird – December 7, 2021

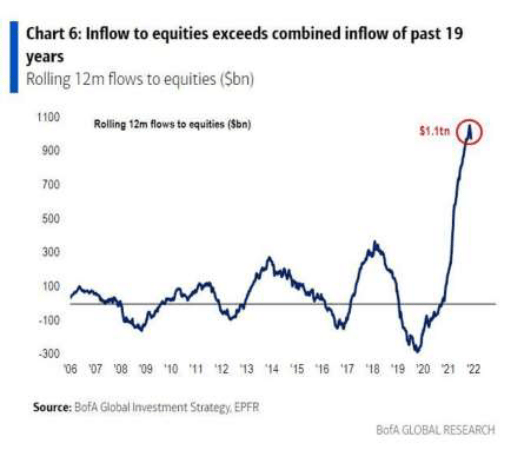

THE MOST SIGNIFICANT CHART OF 2022: CAPITAL FLOWS INTO EQUITIES WERE GREATER IN 2021 THAN THE COMBINED INFLOWS OF THE PREVIOUS 19 YEARS

We have long found that the analysis of capital flows, investor sentiment and market extremes are among the most useful factors to consider in producing superior investment returns and mitigate risk.

All three phenomena are depicted in the chart above.

The enormous capital flows into stocks since the March 2020 market low provided the impetus of the very sharp (and surprising to many) market rally that produced historically narrow market leadership and elevated valuation metrics. As well, the enormous capital inflows reflect a historic level of investor bullishness, aided in no small part by the emergence of a new generation of retail investors using RobinHood and similar trading apps. Most importantly, such market extremes have often preceded important turning points, making the historic level of recent capital flows worthy of consideration by investors seeking to gauge the current risk/reward investment landscape.

The chart says much (most of which is ominous) about the unprecedented current economic/investment climate. We remain of the view that the 2020s will be characterized by unusually high volatility exhibited by capital markets that will produce significant risks but also great opportunities for investors. If we are

correct, the coming years will punish passive investors and richly reward engaged investors for their efforts.

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please visit: https://globalinvestmentletter.com/sample-issue/

Posts You May Like

THE MOST SIGNIFICANT CHART OF 2022: CAPITAL FLOWS INTO EQUITIES WERE GREATER IN 2021 THAN THE COMBINED INFLOWS OF THE PREVIOUS 19 YEARS

By Jonathan Baird - December 7, 2021 We have long found that the analysis of capital flows, investor sentiment and market extremes are among the most useful factors to consider in producing superior investment [...]

THE INTANGIBLE STOCK MARKET?

By Jonathan Baird - November 16, 2021 The ratio of tangible to intangible (e.g., goodwill) has changed substantially over the years. In 1975 fully 83% of the S&P 500’s total assets were classed as [...]

THE VALUE OF GLOBAL STOCK MARKETS EQUALED WORLD GDP IN 2021 FOR ONLY THE SECOND TIME IN HISTORY

Global stock markets, fueled by a combination of unprecedented fiscal and monetary stimulus and extreme investor optimism, have soared to match the value of global GDP. The only previous example of this behaviour [...]