By Jonathan Baird – November 16, 2021

THE INTANGIBLE STOCK MARKET?

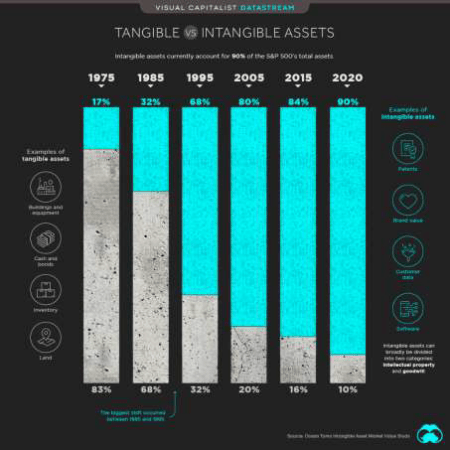

The ratio of tangible to intangible (e.g., goodwill) has changed substantially over the years. In 1975 fully 83% of the S&P 500’s total assets were classed as tangible. That number has now fallen to 10% versus 90% that are intangible.

The trend to a higher ratio of intangible assets on balance sheets began around 1990, which coincides with the rapid evolution of technology that has produced today’s digital world. Technology related companies tend to be valued more by their perceived business franchises than by their tangible assets, so their balance sheets are typically characterized by high levels of intangible assets. As the influence of technology companies’ influence on market indices has grown (especially after the advent of the internet) the percentage of tangible assets carried on the balance sheets of S&P 500 companies fell dramatically.

Rising stock markets over the past 30 years have further exacerbated the dominance of intangible assets on balance sheets, as companies found it easy to issue stock at multiples of book value, which further diminishes the role of tangible assets on balance sheets. The popularity of stock buybacks over the past decade (primarily by companies trading at multiples of book value) has served to amplify this trend.

Not surprisingly, this period of decline in tangible assets on balance sheets has coincided with the underperformance of value stocks compared to growth stocks.

This trend appears unlikely to change substantively as technology-related companies are likely to continue to dominate markets for some time.

That is not to say that value investing no longer has a role. Valuation remains a major influence of future investment returns, which is one factor in our belief that the current risk/reward proposition offered by markets is less than compelling. That said, the rise in the importance of intangible assets in recent decades

serves as a lesson that, as investors, we must strive to be alert to secular market changes such as technological advances.

Technological innovation will continue to exert a significant influence in the coming years, but we are not short of other potential catalysts for market volatility. The fragile global economy and deteriorating geopolitical climate, inflation and the prospect of rising interest rates, and the still uncertain resolution of the COVID pandemic could all play a role in making the next decade challenging for investors.

If you found this post of interest, you’ll find the Global Investment Letter of value. To view free sample issues and to receive our weekly investment comment please visit: https://globalinvestmentletter.com/sample-issue/

Posts You May Like

THE MOST SIGNIFICANT CHART OF 2022: CAPITAL FLOWS INTO EQUITIES WERE GREATER IN 2021 THAN THE COMBINED INFLOWS OF THE PREVIOUS 19 YEARS

By Jonathan Baird - December 7, 2021 We have long found that the analysis of capital flows, investor sentiment and market extremes are among the most useful factors to consider in producing superior investment [...]

THE INTANGIBLE STOCK MARKET?

By Jonathan Baird - November 16, 2021 The ratio of tangible to intangible (e.g., goodwill) has changed substantially over the years. In 1975 fully 83% of the S&P 500’s total assets were classed as [...]

THE VALUE OF GLOBAL STOCK MARKETS EQUALED WORLD GDP IN 2021 FOR ONLY THE SECOND TIME IN HISTORY

Global stock markets, fueled by a combination of unprecedented fiscal and monetary stimulus and extreme investor optimism, have soared to match the value of global GDP. The only previous example of this behaviour [...]